SEVARA MALLYN

I’m a product manager living and working in Los Angeles, CA after pursuing my MBA at UC Berkeley recently – endlessly curious about how people think and act, the way they interact with brands, and how society is changing.

SEVARA MALLYN: Portfolio

A selection of product, strategy and branding work.

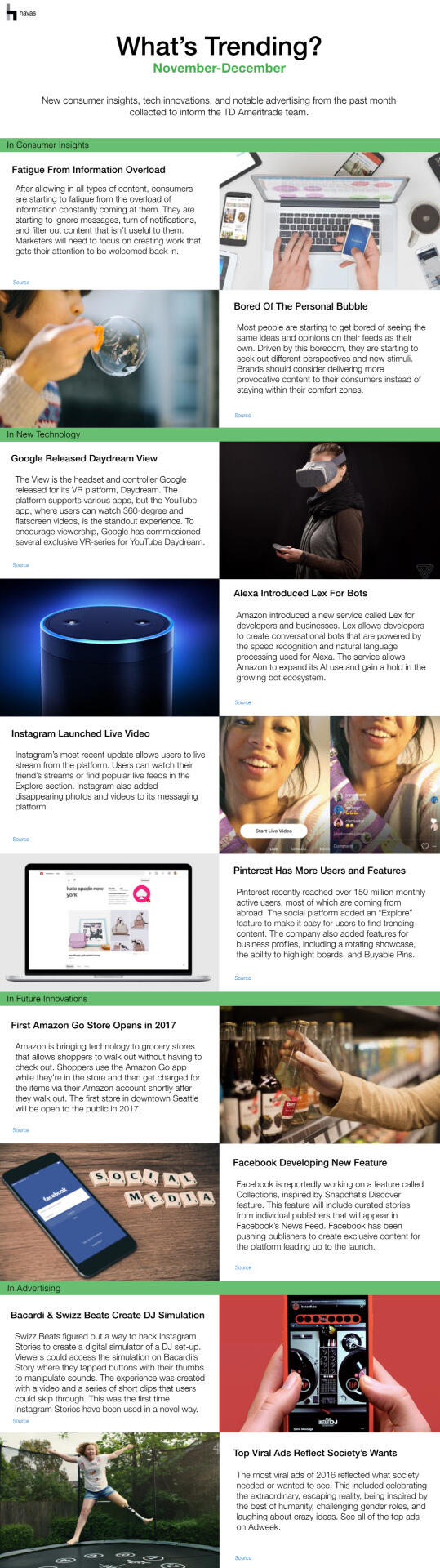

TD AMERITRADE: Monthly Trends

Proactively produced each month and sent to clients.

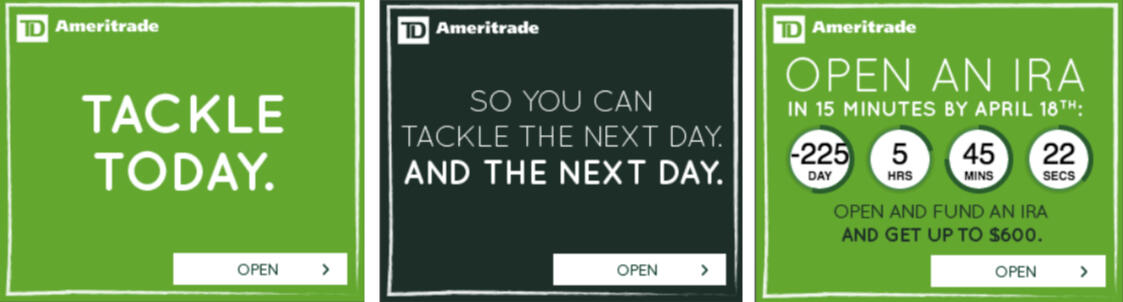

TD AMERITRADE: Urgency Season

Background: TD Ameritrade calls the four months before Tax Day “Urgency Season” because its the time of year when consumers rush to open and fund IRA accounts to get higher tax breaks. While consumers can fund their IRA right after the new year, nearly half wait until the last weeks before the filing deadline to take action. Pushing off funding means that consumer don’t get the full benefit of compounding on their retirement savings, and waiting until the last minute increases the chances of not filling out all paperwork in time. Brokerage firms encourage earlier action because early funding means higher net assets.Challenge: Convince investors to open an IRA account with TD Ameritrade sooner rather than waiting until the last moments before the Tax Day deadline.Insight: Consumers know they need to open an IRA before the deadline, but the process seems time-consuming and complicated. Since they don’t feel rushed early in the year, they continue to put off the task for another day. But once they cross off “open an IRA” off their to-do list, they feel accomplished and satisfied with themselves.Strategy: Convey that opening an IRA with TD Ameritrade today feels good. Pay off the CTA with how easy and fast TD Ameritrade makes it to open and fund an IRA. Focus efforts on digital channels where dynamic countdowns can be utilized to heighten the sense of urgency.

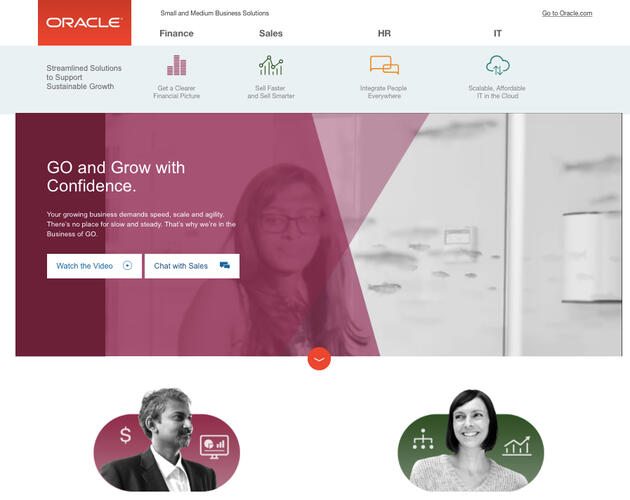

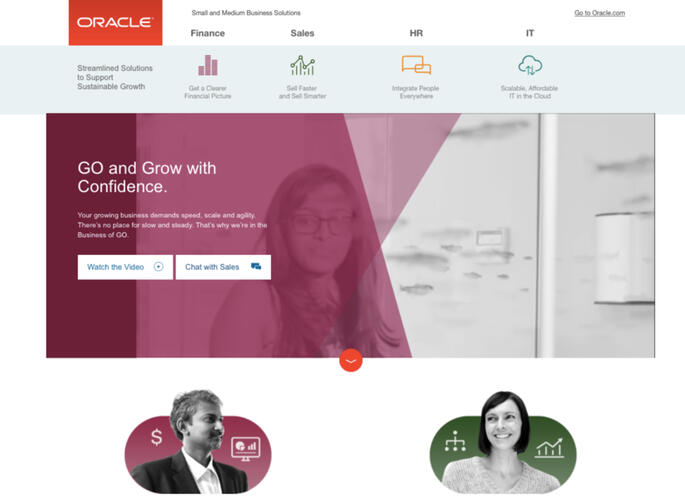

ORACLE: Small & Medium Business Site

Background: After a long history of focusing only on large enterprise customers, Oracle wanted to widen operations to capture the growing small and medium sized business (SMB) market with its various cloud solutions. Oracle launched a series of modular front-end and back-end Apps and Tech products to compete in the crowded cloud market. Their differentiating feature was how they all worked together, offering SMBs a “complete” cloud solution for all their business needs.Challenge: Create a content-driven campaign focused on selling Oracle’s Cloud solutions to SMBs.Insight: SMB executives are seeking solutions for specific problems, like attracting more customers, filling roles with technology, and retaining talent, to help them grow. They are time-poor and stretched thin, so they seek straightforward and simple solutions. Most large companies tout their products, but fail to speak directly to SMB needs.Strategy: Update Oracle’s existing SMB landing page to ensure it speaks directly to SMB needs and offers direct solutions. Create a blog for SMBs and support solutions/products with interesting and educational content. Direct traffic to the new landing page by working with a content created and distributor to publish articles that speak to SMB needs. Additionally, support articles with educational videos and digital ads.

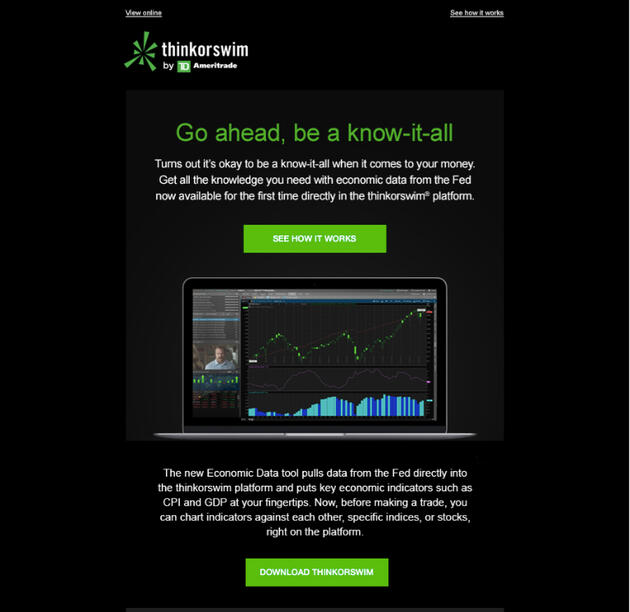

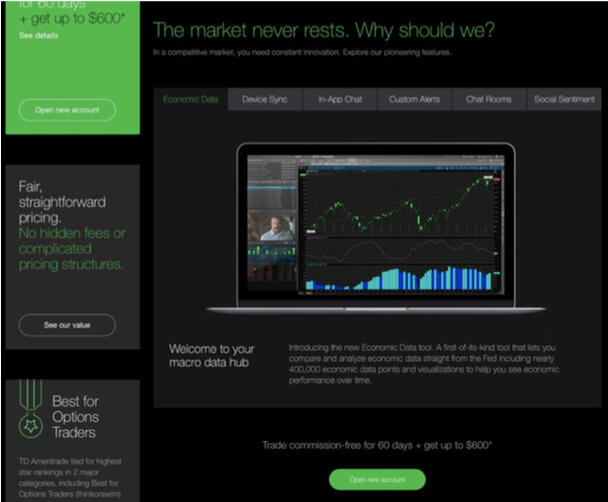

TD AMERITRADE: Economic Data Tool

Background: TD Ameritrade created and launched a new tool on their advanced trading platform, thinkorswim. The first-of-its-kind tool, called “Economic Data,” pulls in data from the Federal Reserve Economic Database (the Fed) directly into the trading platform, allowing traders to easily analyze macroeconomic trends to better inform their trading decisions.Challenge: Promote the launch of the new tool and get both prospect and client traders to download TD Ameritrade’s advanced trading platform.Insight: Experienced traders know that analyzing the Fed data is important, but the process to finding relevant, unbiased information is frustrating and time-consuming. While traders could analyze indicators on the Fed’s website, there was no simple way of analyzing them against a trader’s own stock. Traders generally spend hours wading through various biased sources to get a better understanding of the full picture of the market to be able to make their own predictionsStrategy: Show experienced traders that the thinkorswim platform could act as their all-in-one macro data command center. Convince them that with the new Economic Data too, finding and analyzing the data they need is easy. Create a campaign targeting experienced traders and speak to their need of wanting to know all the available information to get an edge over other traders.

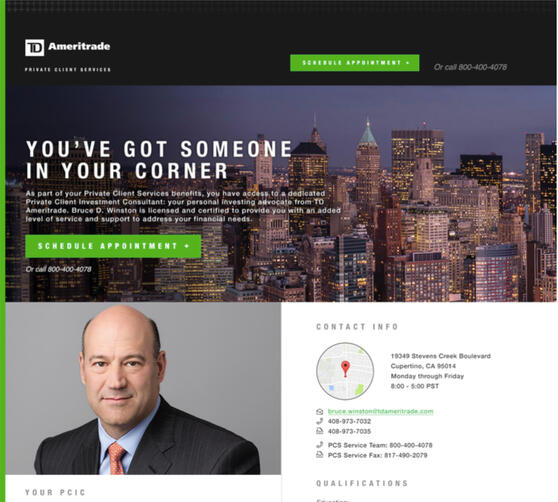

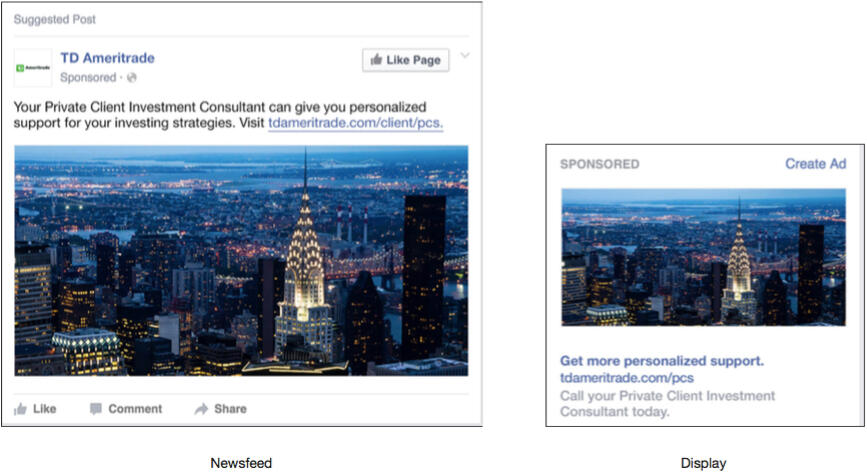

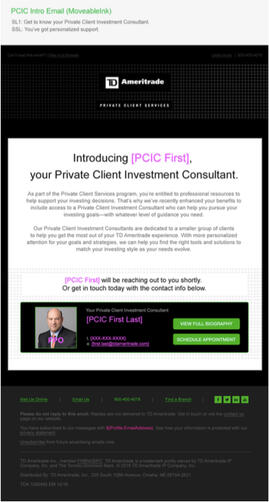

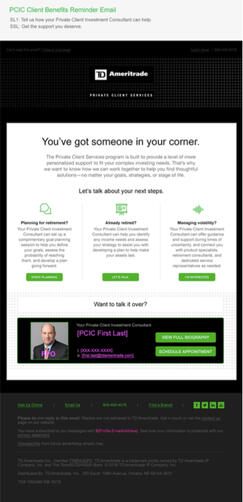

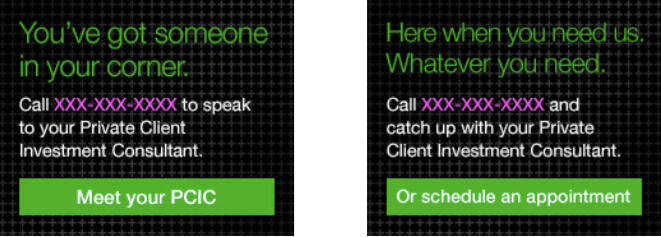

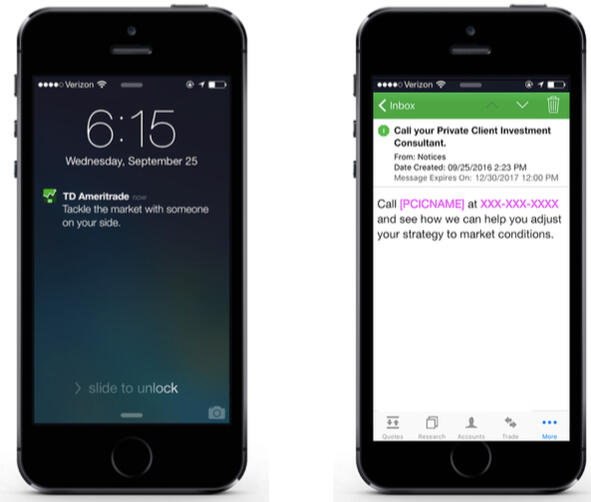

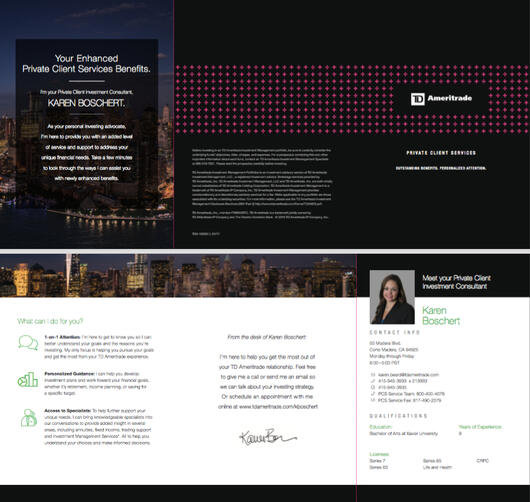

TD AMERITRADE: Always Serving, Never Selling

Background: TD Ameritrade found, that after many years with the company, their high-value clients were leaving for other brokerages that offered advisory services. These high-value investors were at a point in their life where their investing strategies had to change and they sought guidance from professional advisors. To help with retention, TD Ameritrade hired a group of highly-certified and qualified investment consultants who were trained to provide high-value clients more personalized guidance.Challenge: Communicate to high-value clients that their new investment consultant could provide them with the guidance and support they needed at their stage in life.Insight: Clients did not have a strong connection to the company because of high turnover rates of consultants, weren’t aware of what benefits a consultant could provide and didn’t have a habit of communicating with them. Overall they felt that TD Ameritrade didn’t have what they needed to help them manage their investing strategies as they aged.Strategy: Get the word out and build credibility of consultants by welcoming clients to the service through an elite experience. Do this by updating the look and feel of their investing platform, providing them with additional benefits (like free educational resources and events), and sending them a complimentary gift with information about their consultant.

Contact

Let's connect.